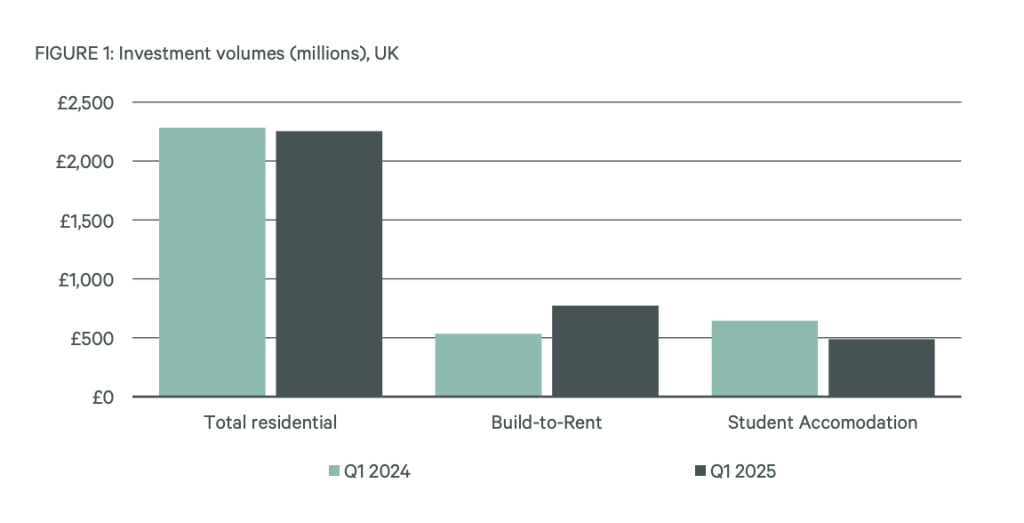

CBRE has reported that investment into the UK’s Living sector totalled £2.3bn in Q1 2025, broadly level to both the end of last year and Q1 2024.

However, purpose-built student accommodation (PBSA) investment declined from the previous quarter. A total of £488m was invested in PBSA in Q1, while in comparison, £774m was invested into the Build to Rent sector, which was 54% higher than Q1 2024.

Notable PBSA transactions in the quarter include Greystar’s acquisition of 400 bedrooms across The Neighbourhood assets in Cardiff and Exeter for £60m, reflecting a yield of 5.60% and a capital value of £150,000 per bedroom. The deal marked Greystar’s expansion into two new UK cities experiencing a significant undersupply of student housing.

M&G’s also acquired a PBSA development in Stratford, east London, from Get Living for £135m. Reaching 18 storeys high, the student accommodation scheme will deliver 504 bedrooms and over 1,500 sqm of amenity space.

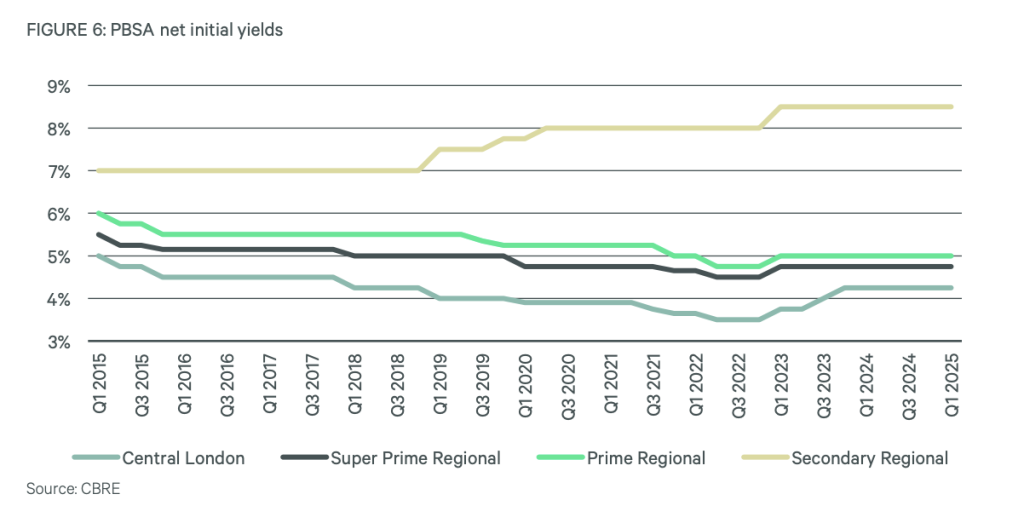

CBRE’s report also highlight that yields in the PBSA sector continued to trend stable – between 4.25% and 5%.

CBRE’S residential investment volumes account for all transactions across the residential spectrum where data is available, including Build to Rent, PBSA, Co-living, Affordable, development land and private investment.