StudentCrowd’s new UK-wide purpose-built student accommodation (PBSA) report reveals that while average PBSA rents continue to rise, a growing number of operators are reintroducing financial incentives. It is a trend now visible across room types, price points and locations.

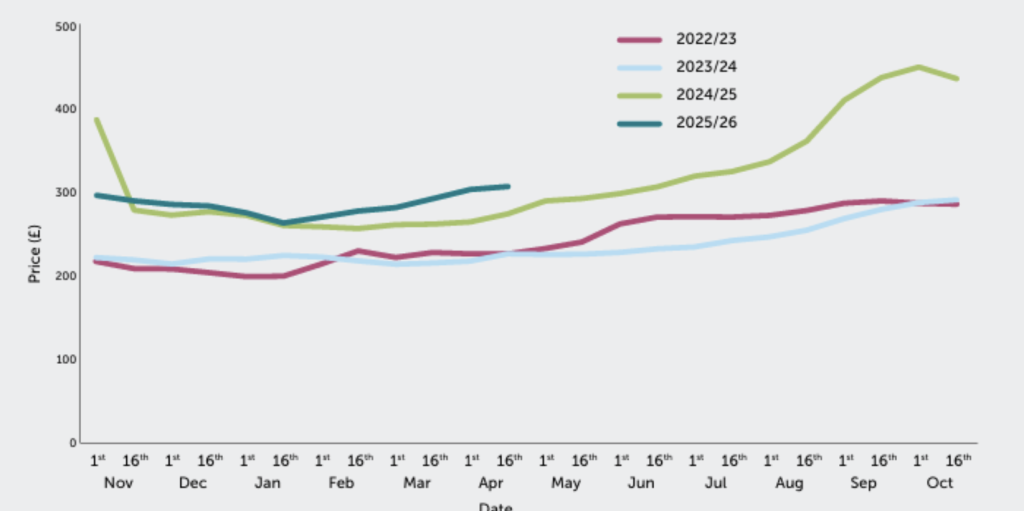

The data shows average rents have grown by 7.5% per year since 2021, while average incentive values have increased by 15% annually over the same period (see Fig 1).

With the cost of living still a concern for many households and UCAS Clearing around the corner, it’s a timely reminder for students and parents to consider the full picture when comparing accommodation, including which providers are offering added value through cashback, discounts, or voucher-based deals.

The figures also show that the average incentive values increasing across all room types this year, with apartments and cluster ensuites offering similar or higher incentive values than studios and incentives being used nationwide, including in high-demand cities and traditional university hotspots.

“After two years of relatively low and stable incentive values, 2024/25 saw the highest figures and greatest range recorded over the four academic years.

“The peaks in November 2024, at the start of the cycle, and again in October 2025, at the end, as well as the similar, albeit less dramatic, pattern displayed to date in 2025/26, suggests that booking patterns may be changing.”

Tuely Robins, Director of Strategic Partnerships, StudentCrowd

The report draws on StudentCrowd’s live dataset, which covers 100% of UK PBSA buildings and over 3.7 billion data points, to provide analysis of pricing, availability and student sentiment.

Other headline trends identified included that 58,000 PBSA beds have been added since 2021, 93,000 bedrooms are currently in the approved planning pipeline, a 16% rise in student numbers since 2019/20, and a 4.37/5 average student satisfaction rating for PBSA.

“With so many moving parts across the student accommodation sector, from development pipelines to pricing pressures and changing student behaviour, it’s never been more important to work from a live, trusted data source. This report brings real figures from across the sector to provide a clear view of how the market is functioning right now.”

Tuely Robins, Director of Strategic Partnerships, StudentCrowd

Alongside national-level analysis, the report highlights how trends can vary between cities and even at postcode level, reinforcing the importance of hyper-local data when assessing pricing, development potential or marketing performance.