Today (9 January 2025), owner, manager and developer of student accommodation – Unite Students – released an update on current trading and quarterly property valuations for the Unite UK Student Accommodation Fund (USAF) and the London Student Accommodation Joint Venture (LSAV) as at 31 December 2024.

With the demand for Unite’s accommodation remaining strong, the outlook for student numbers in 2025/26 is encouraging, with domestic demand underpinned by a 2% larger population of UK-based 18-year-olds.

Unite also sees improving trends in international student demand due to a more settled policy backdrop, after the uncertainty created by changes to student visa rules and the review of the Graduate Route in the first half of 2024.

The latest recruitment data indicates a 14% increase in international student acceptances for courses starting in January 2025.

Across Unite’s portfolio, 66% of rooms are now reserved for the 2025/26 academic year, in-line with long-term leasing rates and slightly below the exceptional levels the company has seen in the last two years (2024/25: 70%).

“We have seen a strong start to the 2025/26 sales cycle, highlighting the continued demand for our high-quality accommodation from both students and universities.

“The outlook for student numbers remains positive with a growing UK 18-year-old population and improving trends in international student recruitment given a more settled policy backdrop in recent months.

“This supports our confidence in delivering full occupancy and rental growth of 4% to 5% for the 2025/26 academic year.

“We have also continued to make good progress with the delivery of our development pipeline and have acquired eight investment properties, with value-add potential, in recent weeks.

“These transactions grow our presence in some of the UK’s leading university cities where demand for accommodation is strongest.”

Joe Lister, Chief Executive Officer, Unite Students

The student accommodation provider observed a normalisation in leasing trends over the course of 2024, which it expects to continue for the 2025/26 sales cycle with more bookings made later in the cycle.

Unite has stated that it has been ‘encouraged’ by the strength of demand from its university partners, with 700 extra beds reserved through nomination agreements compared to the same stage of the 2024/25 sales cycle.

The positive start to the sales cycle supports 97% to 98% occupancy and 4% to 5% rental growth in the 2025/26 academic year. Unite remains focussed on offering value-for-money accommodation, while also delivering sustainable rental growth to mitigate future cost increases linked to the Real Living Wage and higher National Insurance contributions, and support the significant ongoing investment into the company’s properties.

Unite has continued to make progress in deploying the proceeds of its £450m equity raise, in line with investment targets. During the quarter, Unite completed the acquisition of seven assets from USAF, part funded by the sale of two assets, and acquired the land at its Central Quay development project in Glasgow.

Following these transactions, it has now deployed around 50% of the proceeds from the company’s July 2024 equity raise.

In November, Unite acquired the freehold interest of a 260-unit development in London for £37m, which the company had previously sold and leased back from the freeholder.

The scheme was acquired at below replacement cost and has value-add investment potential upon expiry of a nomination agreement in 2026.

Now, Unite’s committed development pipeline of eight projects totals 6,600 beds. The student accommodation provider has declared its focus on delivering these developments with its construction partners and, for the schemes subject to the Building Safety Act (BSA), the Building Safety Regulator (BSR).

The development programmes reflect the expected impact of the BSA, which will add around six months to delivery timelines for new student accommodation due to new approval gateways.

Unite believes that, with any new regulation, this presents risks of delay due to capacity constraints at the Building Safety Regulator. However, the company will continue to work closely with the BSR to deliver safe and secure homes for students in line with its target delivery timetable.

A planning application for the company’s Newcastle University joint venture was submitted in the summer. The application is expected to be sent to the committee early this year. Unite is also making ‘good’ progress with a second University joint venture, which it expects to announce within the next three to six months.

Trading in the fourth quarter has been in-line with expectations. Unite maintains its previous guidance for adjusted EPS at the upper end of its 45.5p to 46.5p range.

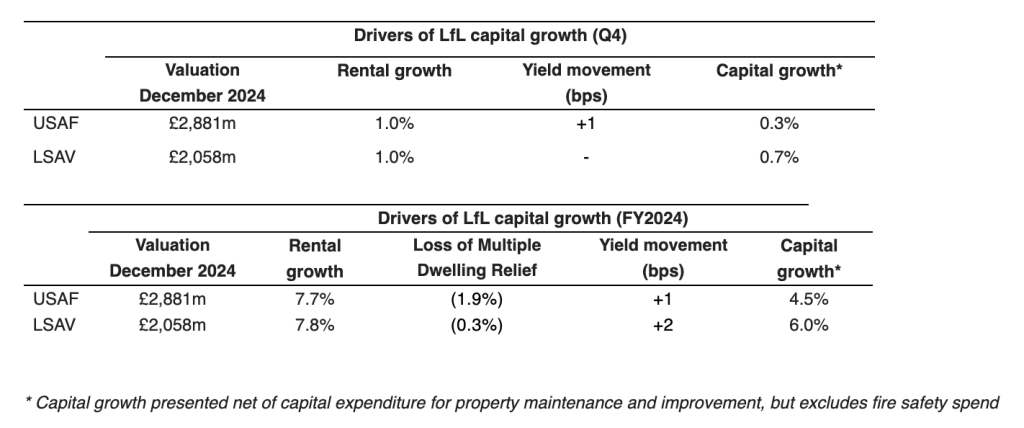

At 31 December 2024, USAF’s property portfolio was independently valued at £2,881m – a 0.3% increase on a like-for-like basis during the quarter and 4.5% for the year.

The valuation increase reflects quarterly rental growth of 1.0%. Property yields were broadly stable over the quarter at 5.2%. The portfolio comprises 24,326 beds in 61 properties across 19 university towns and cities in the UK.

LSAV’s property portfolio was independently valued at £2,058m – a 0.7% increase on a like-for-like basis during the quarter and 6.0% for the year.

The valuation increase in LSAV is driven by quarterly rental growth of 1.0%. Property yields were unchanged over the quarter at 4.5%. LSAV’s portfolio comprises 9,710 beds across 14 properties in London and Aston Student Village in Birmingham.